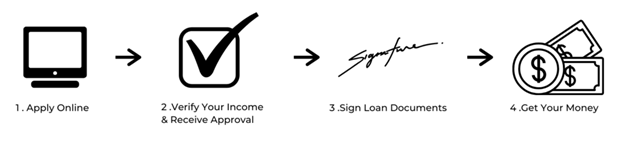

How Do Online Loans Works?

With AAR Mortgage, you don’t need to visit a store to apply for your loan. You can complete the application and get the money in your bank 100% online.

Our contactless loan is easy and fast.

ABOUT US

We are AAR! We are a team of individuals, working together to help you make your way to financial freedom. We love saying yes, we love educating customers and are always here to assist you with whatever you may need. At AAR, we work together with you to provide you with the most suitable loans our company can offer, no matter your credit past. Our friendly staff and easy application process will get you a flexible payment schedule in no time.

FREQUENTLY ASKED QUESTIONS

How is AAR Mortgage different than a bank?

At AAR Mortgage, we provide you with loan solutions, when other banks may turn you away. We work with you one on one to make sure the loan solution you choose is right for you.

I received an AAR Mortgage flyer in the mail, what do I do with it?

You can call us at (204) 224 3271 to discuss your options

with a loan specialist, or go online to our apply now page

to fill out an application for a loan. You can also bring in your flyer to your

AAR Mortgage branch and meet with a loans specialist.

Quick Links

823 Regent Ave West

Winnipeg, Manitoba

Canada, R2C 3A7

Call Us @ 204-224-3271

Email Us @ info@aarmortgage.ca

aarmortgage©2026. All rights reserved.